Overview

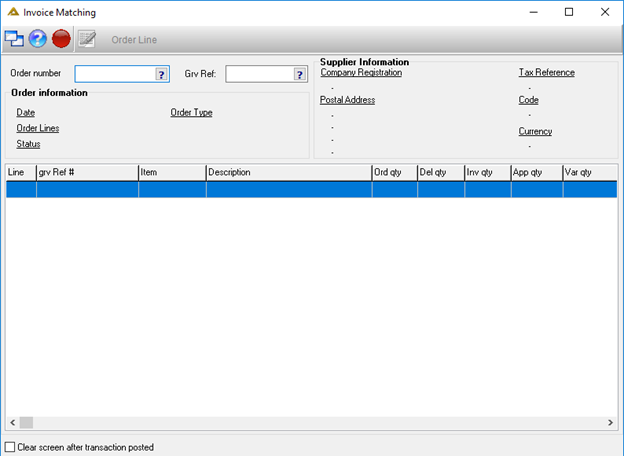

This application allows you to do complete invoice matching.

If parameter WF_INV_CA_APPR is set to Y, the invoice will route to the applicable cost accountant for approval before routing to the responsibility as per the order.

Function

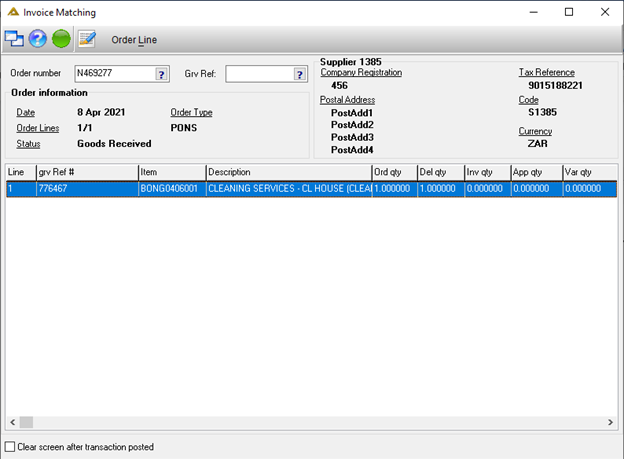

When the application is opened, you will view the following:

Select the order number by manually entering it into the field or by using the picker.

Once the order number has been selected, the details for the selected order will be displayed in the grid.

Click on the ![]() button or double click the line in order to view the GRV transaction.

button or double click the line in order to view the GRV transaction.

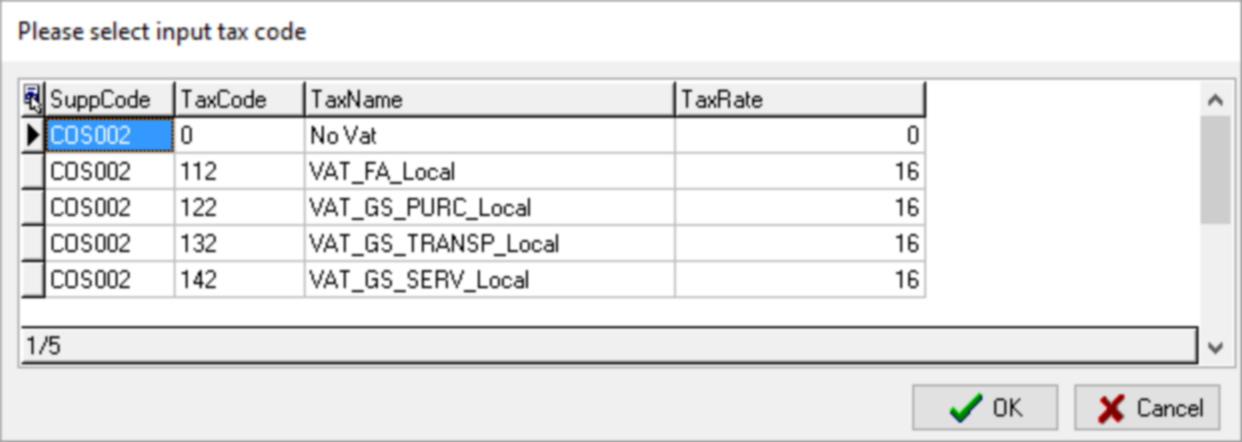

If your company uses the withholding tax functionality the following options will be available (for all but service orders) for your selection:

Withholding tax is calculated on the invoice value excluding tax/VAT.

VAT differences will be allowed when invoice matching.

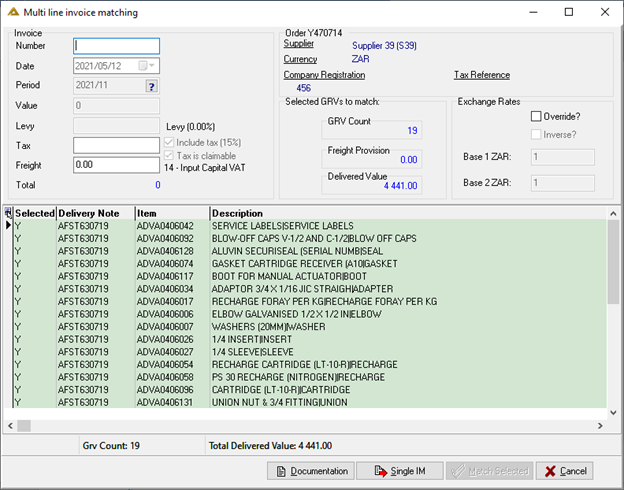

Multiple order lines will give the following option:

There are options to override the exchange rate and view the inverse of the exchange rate. The inverse option will be disabled but will enable when the override exchange rate tick box is ticked, provided access rights for the user profile has been granted in the Profile Maintenance application.

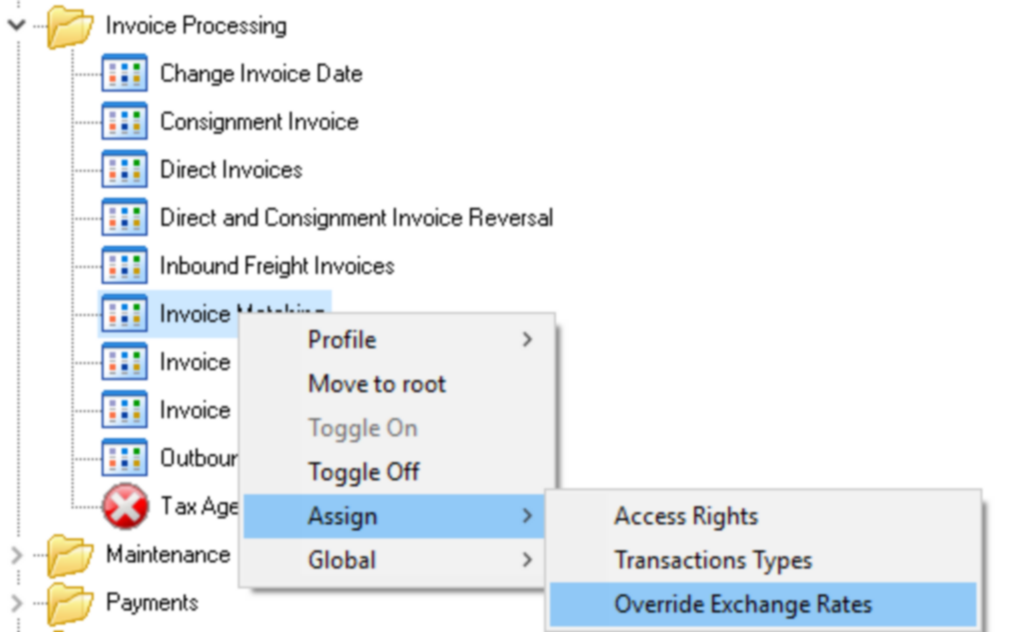

In Profile Maintenance, go to Invoice Matching, right click and click on Assign. Choose Override Exchange Rates. A dialog will open, select the Allow radio button and ![]()

Pro-rata sundry charges can be posted for each line.

The ![]() button allows you to upload supporting documentation.

button allows you to upload supporting documentation.

For multi-line invoice matching, complete all the required fields before the ![]() button will be enabled.

button will be enabled.

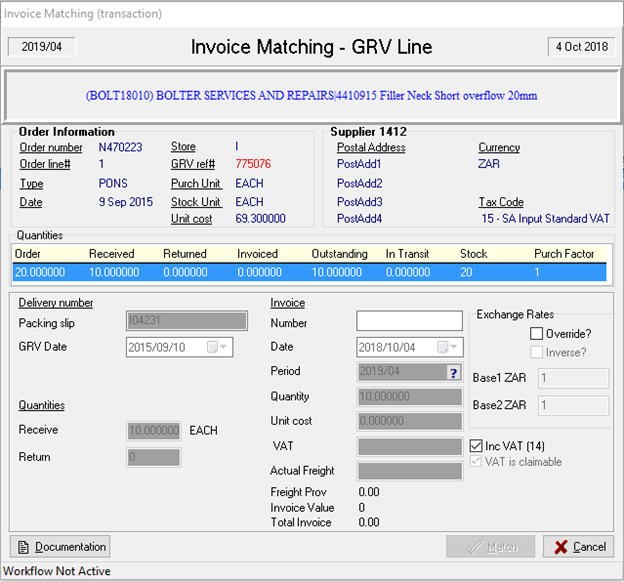

The ![]() button will open the Invoice Matching - GRV Line screen. It is the same screen used for single line invoices:

button will open the Invoice Matching - GRV Line screen. It is the same screen used for single line invoices:

Override and Inverse exchange rates tick boxes will function as described for multiline matching.

If you have completed the freight fields in the Purchase Order Confirmation application, you will be prompted to capture freight before completing the invoice matching process.

Note that reverse VAT entries will be inserted automatically when processing an invoice, selection of Tax is not available for these transactions.

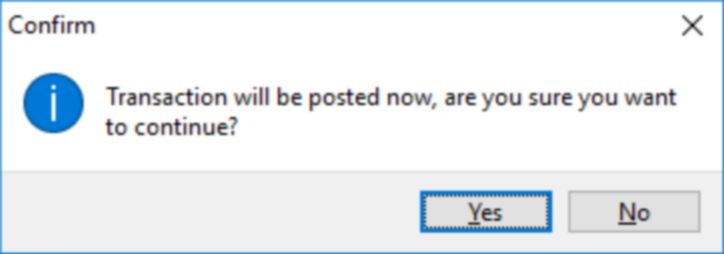

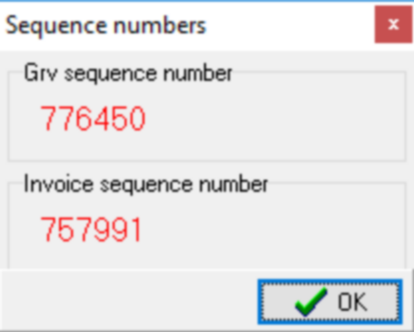

Enter in the Invoice Number, select the date, the quantity and unit cost. Once completed, click on ![]() .

.

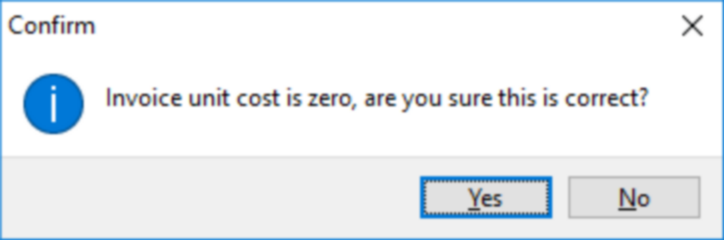

If the invoice value has a zero unit cost, you will receive the following confirmation message: