Overview

This application is used to match invoices to consignment stock issued.

Function

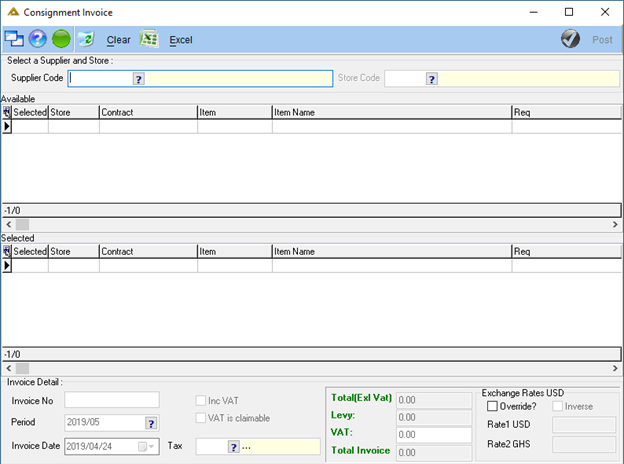

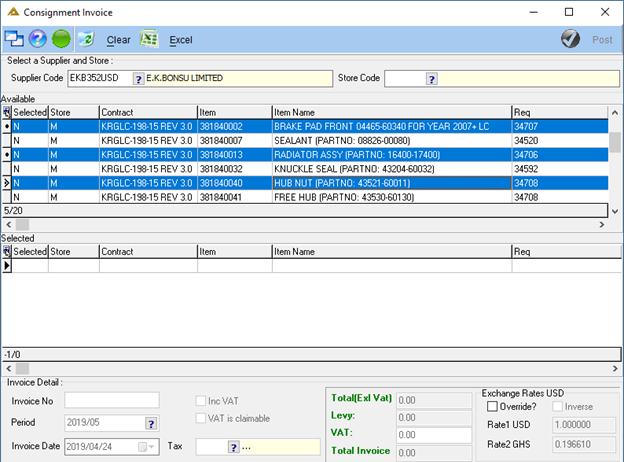

When the application is opened you will view the following screen:

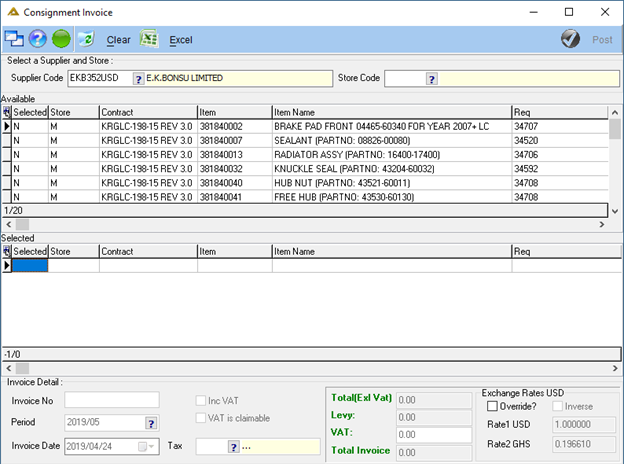

Enter the supplier code manually or select it using the picker. The available contract items will be displayed in the grid:

To select contract items to be matched, double click on a line in the grid to move it to the bottom grid.

To select multiple lines to move to the bottom grid, hold the Ctrl key on your keyboard while selecting them:

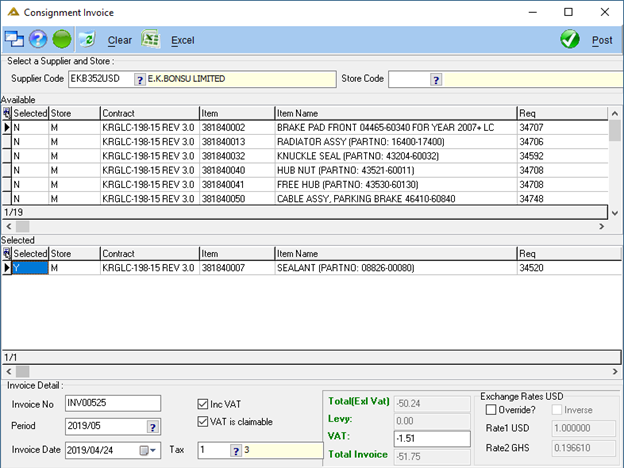

You can move the item lines to the top grid again by double clicking on the line in the bottom grid. After selecting all the lines, enter the Invoice number.

Choose whether VAT is included and if VAT is claimable for this invoice. Select the Tax code to be applied. You can override the currencies by clicking on the ‘Override’ check box.

After completing all the fields, click on the ![]() button to post the consignment invoice information captured.

button to post the consignment invoice information captured.

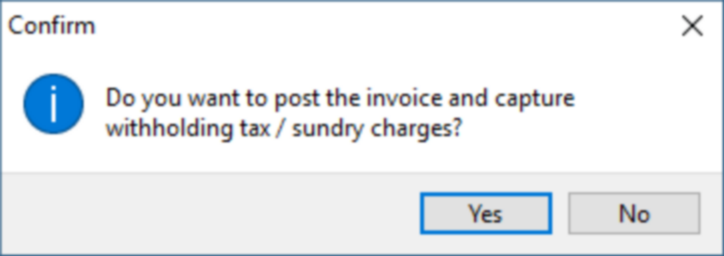

If you are using the withholding tax functionality, the following screen will be displayed after posting:

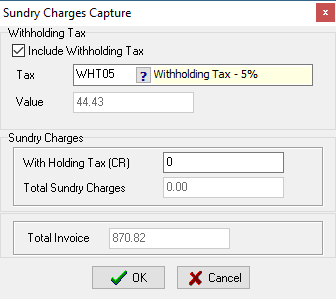

Click on the ![]() button to capture the withholding tax / sundry charges:

button to capture the withholding tax / sundry charges:

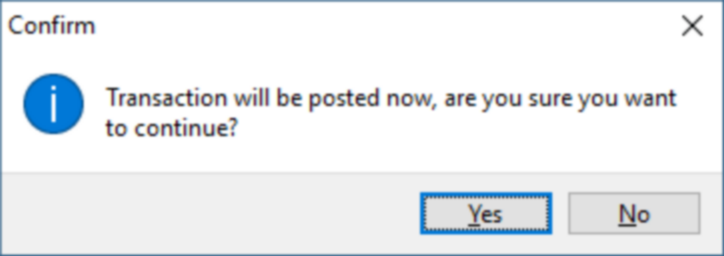

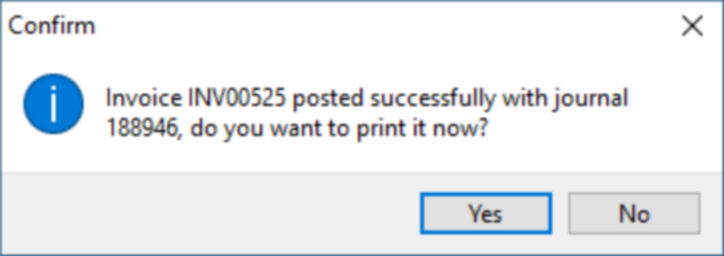

Once you have completed this, click on the ![]() button. You will receive the following confirmation messages:

button. You will receive the following confirmation messages:

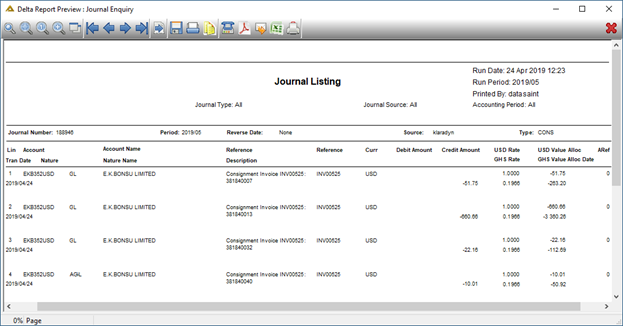

The journal listing preview will be displayed if you select ![]()

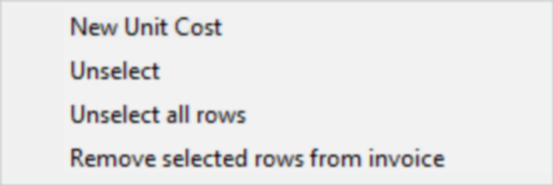

If you right click on the grid you will have the following options:

You need to have access level ‘Other’ to have the ‘New Unit Cost’ option available for selection.

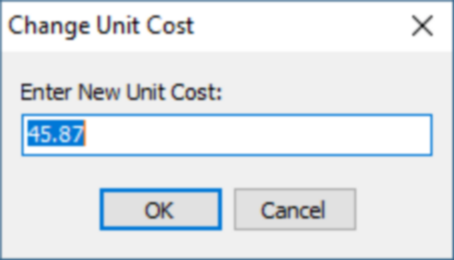

This option should only be used in special cases where a contract item’s unit cost should be changed for the consignment items and invoices. At the time of the invoice the price of the item as per the contract will be used unless changed using this option. If you choose to change the unit cost, the following screen will be displayed. You can manually enter the new unit cost for the selected item: