Overview

This application caters for posting or cancelling an advance payment against a specific order, order line, value and payment schedule.

Rules Applied

•To allow the capture of advance payments, you have to select the tick box – allow advance payments using the Supplier Maintenance application.

•Advance payments are captured against an order and order line, this could be a %, but not more than 100% of the value for each order/order line.

•An option exists to have tax added to advanced payments. This is controlled by the country code on the supplier record and is set up with a parameter.

•Advanced Payments cannot be captured against an order or order line that has already gone through the GRV (Goods Received Verification) process and can only be captured against released orders with a captured advanced payment schedule.

•Multiple payment schedules may be captured for the same order and order line not exceeding the total value of the order line.

•For Manual capture: Advanced payments are raised to an existing Advanced Payment Schedule and posted to a General Ledger account that is set up in the background.

•Advanced Payments can be captured without an Advanced Payment schedule set up. When confirming a requisition or order before releasing with Purchase Order Confirmation application, or manually with Advanced Payment Schedule Application.

•Advanced Payments can only be captured against Suppliers where the Advanced Payment checkbox is ticked under Supplier Maintenance, Financial tab.

The following entries are posted in the accounting cycle.

No. |

Account |

Dr |

Cr |

Comment |

1. |

Advance payment control account |

X |

|

This entry posts the pro-forma to send to the supplier account against which the payment will be done. |

|

Supplier |

|

X |

|

2. |

Supplier |

X |

|

The pro-forma invoice is paid. |

|

Bank |

|

X |

|

3.1 |

Stock/Cost |

X |

|

The goods are received. |

|

GRV Suspense |

|

X |

|

3.2 |

Advance Payment control account |

X |

|

The advance invoice is cleared from the advance payment control account and supplier account. |

|

Supplier |

|

X |

|

4. |

GRV Suspense |

|

X |

Normal invoice matching is done, clearing the GRV suspense and posting the invoice to the supplier. The amount payable to the supplier is the balance between what was paid and the matched invoice. |

|

Supplier |

X |

|

Function

Raise an Advance Payment

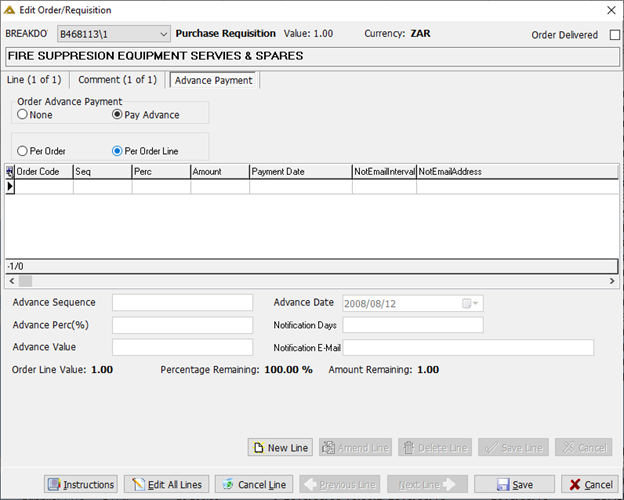

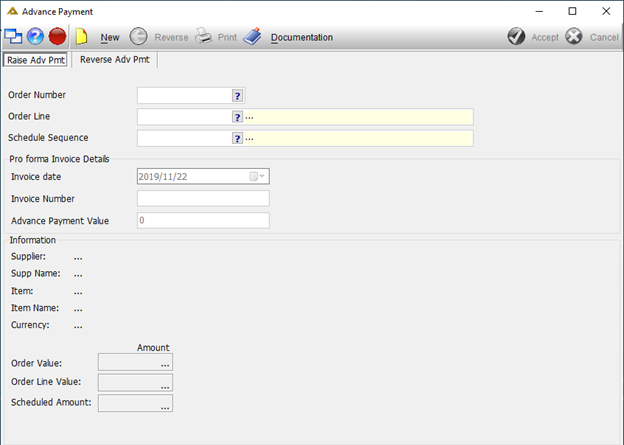

When the application is opened you will view the following:

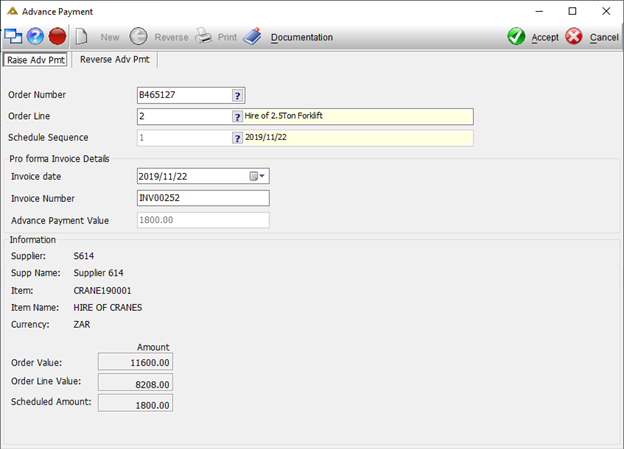

Click on the ![]() button and select the order using the picker or manually enter it into the field. Complete the remaining fields as required.

button and select the order using the picker or manually enter it into the field. Complete the remaining fields as required.

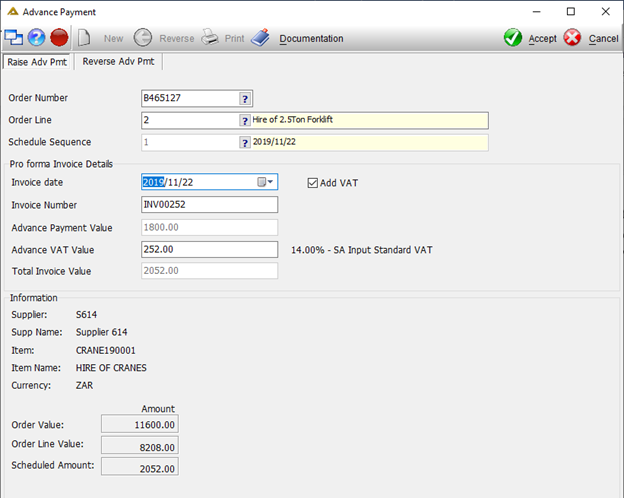

VAT on advance payments will be allowed if parameter ADV_PMT_ALLOW_VAT is set to Y and ADV_PMT_VAT_LOC is set to the corresponding country code as per Supplier Maintenance. Also ensure that the supplier has the correct/applicable VAT codes selected using Supplier Maintenance. The Add VAT tick box will be displayed as per below screenshot:

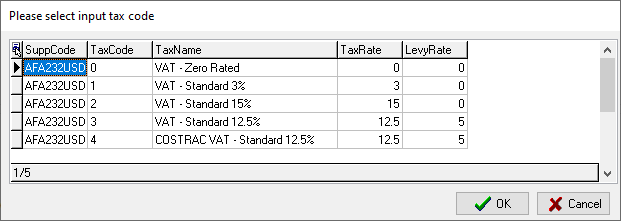

If more than one VAT code is applicable to the supplier, you will have the option to select which one should be applied:

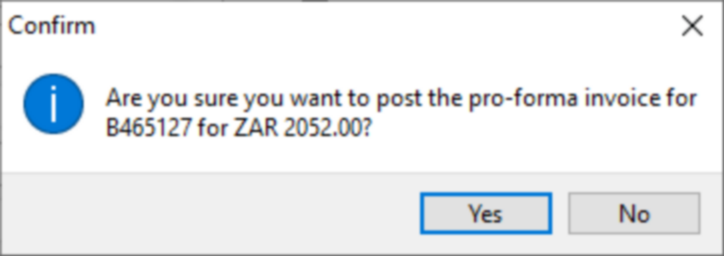

After completing the details, click on the ![]() button to save the advance payment invoice.

button to save the advance payment invoice.

Reverse an Advance Payment

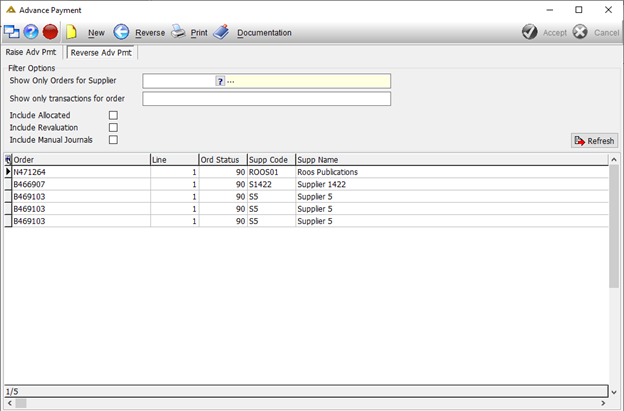

Select the Reverse Adv Pmt tab. You will view the following:

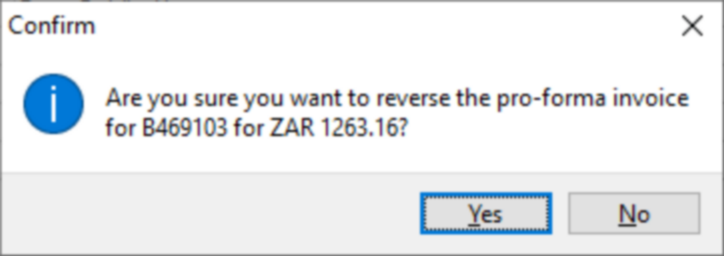

The advance payments shown can be filtered by supplier, order, allocated, revaluation and month end journals. Select the line you wish to reverse and click on the ![]() button.

button.

The ![]() button gives you the following options:

button gives you the following options:

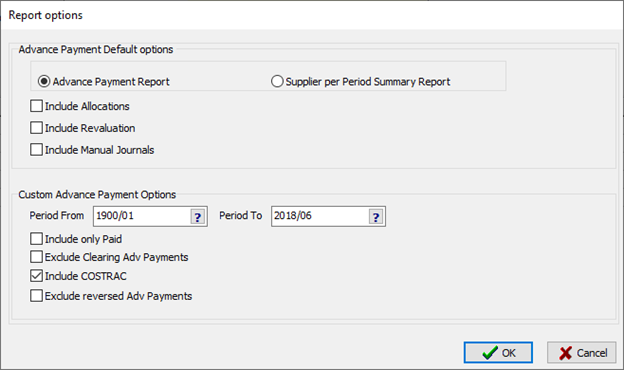

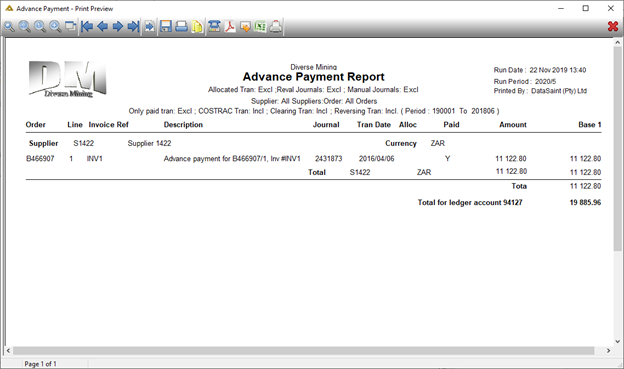

Complete the selection and click on the ![]() button to generate a print preview:

button to generate a print preview:

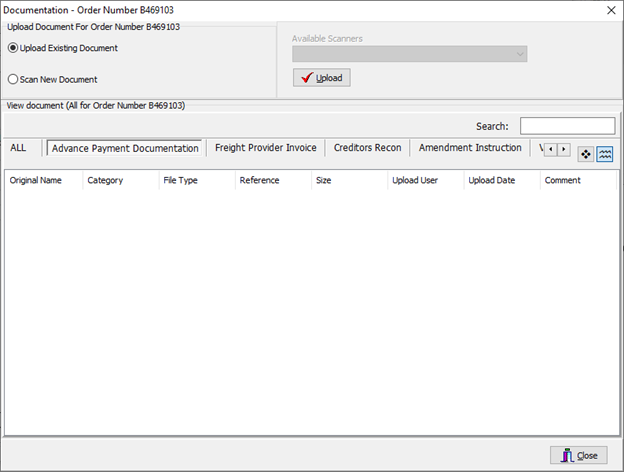

The ![]() button allows you to upload or view any supporting documentation to the advance payment:

button allows you to upload or view any supporting documentation to the advance payment:

The ![]() button will refresh the grid.

button will refresh the grid.